California may be easing into a soft landing with signs of “ebbing optimism” among developers on the three-year outlook for the state’s commercial and multifamily real estate markets.

The new Summer/Fall 2017 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey indicates slower growth ahead in office, retail, and industrial. One of the goals of the survey, which is now in its tenth year, is to address “turning points” in the market, says Jerry Nickelsburg, director of the UCLA Anderson Forecast. “What is significant about the latest survey is that we are now seeing the turning points in most aspects of commercial real estate in California,” he says.

The survey asks respondents where they think rental rates and vacancies will be three years from now. After hitting “rock bottom” in late 2009, the U.S. economy has been moving forward with steady growth for the past seven years, says John Tipton, a real estate partner at Allen Matkins. “So, it is not surprising to see some of the confidence waning,” he says. “Where it gets to be a little more concerning is where you have this more persistent pessimism.”

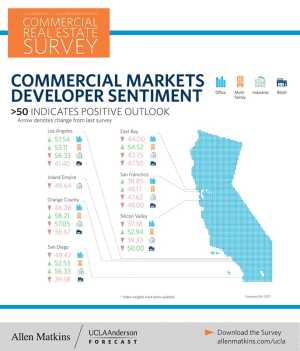

In the office market, for example, Silicon Valley, San Francisco, and the East Bay led the office market out of the recession. Those markets jumped out as the hottest and fastest-recovering markets. Now all three are below 50 on the survey’s sentiment index, which is the “neutral” line between pessimism and optimism. Orange County and San Diego also saw survey sentiment dip below 50. “That leads one to believe that there could be a little bit more of a correction on the horizon,” notes Tipton.

The bright spot in office is Los Angeles, where things have not only remained positive, at 57.5, but there also has been a slight increase in the amount of optimism as compared with the last survey that published in December. Multifamily also saw an uptick in sentiment as compared with the last survey that was published in December. So, it is important to note that sentiment is not cooling across the board, Tipton adds.

Multifamily has been one of the two sectors of the survey, industrial being the other, that has consistently recorded positive sentiment. However, there was a sharp drop in multifamily sentiment in the December 2016 survey. The view at that time was that the market had been so hot for so long that it was natural that growth was slowing and sentiment was cooling, notes Tipton.

However, the results of this survey show that sentiment has rebounded, particularly in Silicon Valley and San Francisco, where sentiment dropped to nearly 40. Some factors contributing to the reversal in sentiment include strong employment growth and income gains, both of which support demand for rental housing. In every market, developers are optimistic about the course of rental and occupancy rates for the next three years, and three-fourths of survey respondents said they plan to start a new project in the coming year, with over one-half of them starting more than one project.

Office Sentiment Is Mixed

The outlook for office is continuing to trend lower. The office sentiment index has dropped from highs near 80 to below 50. The index went below 50 for San Francisco two years ago, and below 50 for Silicon Valley and the East Bay in June 2016. Despite healthy unemployment levels that are now at 4.4 percent, panelists are concerned that occupancies will not be able to maintain current levels and that rents will not be able to keep up with inflation.

Respondents are more bullish on the outlook for Los Angeles. Downtown L.A. in particular is in the midst of a building boom. In contrast, survey results highlighted some potential warning signs in the Bay Area where sentiment remains at a low of 38.85. However, some industry experts are more confident that the market still has good growth potential.

Eighteen months ago, the San Francisco office market saw a pause in demand. Companies started shedding space, the sublease market picked up, and rents have been flat for 18 to 24 months, notes Meade N. Boutwell, a senior vice president, brokerage services, at CBRE in San Francisco. In part, that was a cooling of a six-year hot streak, adds Boutwell. “At this moment in time, demand is strong and even getting a little stronger,” he says.

San Francisco also has a cap on its development pipeline that has been in place for some 30-plus years. That cap tends to keep new supply in check. “Essentially, we have reached that cap and the supply is going to be very restricted going forward,” says Boutwell. That cap also could create some additional upward pressure on rents, he adds.

Push/Pull Continues in Retail and Industrial

Industrial has benefited from the disruptive impact that e-commerce is having on the retail sector, with more companies focused on the delivery of retail goods bought online. However, both retail and industrial saw cooling of sentiment in the current survey. Developer sentiment is trending negative, at or below an index level of 50 for Silicon Valley, East Bay, San Francisco, and the Inland Empire, while developers are more positive about opportunities in Orange County, Los Angeles, and San Diego.

The interpretation of those results from the UCLA economists is that even though there has been a pullback in sentiment regarding the industrial outlook, it may indicate a shift from a “white hot” market to a “red hot” market. The majority of survey respondents (87 percent) started new projects last year and all said they will be active with existing or new projects this year. Part of that cooling sentiment may be influenced by the fact that there is some natural constraint on new supply. There are not a lot of industrial areas to develop in urban areas, such as Los Angeles or San Francisco, as compared with other markets like the Inland Empire, notes Tipton.

The other side of the e-commerce coin is retail, which continues to struggle with increased competition and changing omni-channel business models. Those surveyed are bracing for a retail sector that will look worse in 2020 than it does today. In fact, sentiment across all six California markets declined in the most recent survey, with a high rating of neutral, or 50, in Silicon Valley, and with Orange County on the low end with sentiment dropping to 38.7.

One of the takeaways from this survey is that sentiment is cooling, which is not unexpected after seven years of growth. However, there are still challenges and opportunities in the California commercial real estate market, notes Tipton. “A rising or falling tide does affect all boats, but at the end of the day, when you are making investment decisions, you are trying to look at a specific location,” he says. “It’s not like buying a stock. You are literally looking at this street corner, this product type, and making those investment decisions.”