News & Insights

Legal Alert

New Filing Fees in Connection with CFIUS Review of Foreign Participation in U.S. Real Estate Transactions

Real Estate

5.12.20

On April 27, 2020, the United States Department of the Treasury issued an interim rule (31 C.F.R. parts 800 and 202) establishing filing fees for certain transactions filing any formal written notice for review with CFIUS. Effective May 1, 2020, these filing fees cover all transactions filing for voluntary CFIUS review and will be used to offset associated costs. Concurrent to issuing and finalizing the rule, the Treasury Department established an additional comment period to run through June 1, 2020.

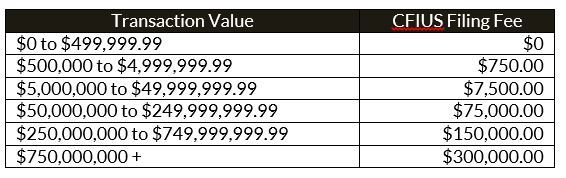

Effective as of May 1, 2020, the tiered filing fee structure (calculated on the transaction value) is as follows:

The filing fees apply to any formal written notice of a "covered transaction" or "covered real estate transaction" seeking CFIUS review and are generally due with the filing. In certain limited circumstances, CFIUS may waive the filing fees or issue refunds. CFIUS broadly defines a “covered transaction” to be any transaction that would be a potential threat to U.S. national security or critical infrastructure, including mergers, acquisitions, or takeovers by or with any foreign person that could result in foreign control of a U.S. business. Since "foreign control" is generally defined as the foreign person having the ability (after the covered transaction is consummated) to cause the U.S. business to either take an action, or refrain from taking an action, related to the (i) management, (ii) operations or (iii) disposition of business assets, certain real estate transactions involving foreign participation fall under CFIUS review and will be subject to the above filing fees.

According to the Treasury Department's announcement, for purposes of determining the amount of the fee, the value of a transaction will be the total value of all consideration paid by or on behalf of the foreign person that is a party to the transaction (e.g., cash, shares, or other in-kind consideration). Payments must be made at the time that a notice is formally filed with CFIUS (unless a waiver has been issued), and CFIUS generally will not commence its review unless and until the filing fee has been paid.

Real estate organizations seeking financing, investment or other participation of foreign sources in U.S. real estate transactions should determine whether their transaction falls under CFIUS review, and if so, take note of the current filing fees payable in connection with any such review.

Authors

Partner

Senior Counsel

RELATED SERVICES

RELATED INDUSTRIES

Allen Matkins Leck Gamble Mallory & Natsis LLP. All Rights Reserved.

This publication is made available by Allen Matkins Leck Gamble Mallory & Natsis LLP for educational purposes only to convey general information and a general understanding of the law, not to provide specific legal advice. By using this website you acknowledge there is no attorney client relationship between you and Allen Matkins Leck Gamble Mallory & Natsis LLP. This publication should not be used as a substitute for competent legal advice from a licensed professional attorney applied to your circumstances. Attorney advertising. Prior results do not guarantee a similar outcome. Full Disclaimer